Conns Payments: A Comprehensive Guide To Streamline Your Financial Journey

So, you've probably heard the buzz around Conns Payments, right? Whether you're a business owner looking to optimize your payment solutions or someone trying to manage personal finances more efficiently, Conns Payments is making waves in the financial world. It’s not just another payment platform; it’s a game-changer that could revolutionize how you handle money. Let me break it down for ya! From simplifying transactions to ensuring security, Conns Payments has got your back.

Now, let’s be real here. Managing payments can be a nightmare, especially if you're juggling multiple accounts, deadlines, and fees. That's where Conns Payments steps in. Designed with both businesses and individuals in mind, this platform offers a seamless way to handle everything from bill payments to credit management. No more stressing over late fees or complicated processes. Conns Payments simplifies the entire experience, leaving you with more time to focus on what truly matters.

Before we dive deep into the nitty-gritty, let’s talk about why you should care. In today’s fast-paced world, having a reliable payment solution is essential. Whether you're running a small business or managing household expenses, the right tools make all the difference. Conns Payments isn't just about convenience—it's about empowering you to take control of your financial future. Stick around, and I'll show you exactly how it works and why it might be the perfect fit for you.

What Are Conns Payments?

Alright, buckle up because we’re about to get into the meat of things. Conns Payments, in its simplest form, is a financial service designed to streamline payment processes for businesses and individuals alike. Think of it as your personal finance assistant that handles everything from credit card payments to utility bills without breaking a sweat. It’s like having a financial wizard in your pocket, but way cooler.

This platform operates under the umbrella of Conns, Inc., a well-established company known for its retail and financial services. Conns Payments isn’t just another app; it’s a comprehensive solution that addresses the pain points of traditional payment methods. With features like automated payments, real-time transaction tracking, and robust security measures, it’s no wonder people are flocking to it. Let’s face it, who wouldn’t want an easier way to manage their money?

How Conns Payments Works

Let’s break it down step by step. First off, signing up for Conns Payments is a breeze. You’ll need to provide some basic info, link your accounts, and voila! You’re good to go. Once you’re set up, the platform allows you to schedule payments, monitor transactions, and even set up alerts for upcoming bills. It’s like having a financial assistant who never takes a day off.

One of the coolest features is the ability to manage multiple accounts from one place. Whether you're paying off a credit card, settling utility bills, or handling business expenses, Conns Payments keeps everything organized. Plus, the user-friendly interface ensures that even tech newbies can navigate it with ease. No more digging through piles of paperwork or stressing over missed payments. Conns Payments has got you covered.

Why Choose Conns Payments?

Here’s the thing: there are plenty of payment platforms out there, but Conns Payments stands out for all the right reasons. First and foremost, it’s incredibly secure. With top-notch encryption and fraud protection, you can rest assured that your financial info is in safe hands. In a world where data breaches are all too common, this level of security is a huge plus.

But it’s not just about security. Conns Payments also offers unparalleled convenience. Imagine being able to pay all your bills in one go, without ever leaving the comfort of your couch. Sounds pretty sweet, right? And let’s not forget the cost savings. By automating payments and helping you avoid late fees, Conns Payments can actually save you money in the long run. It’s like having a financial superhero on your side.

Key Features of Conns Payments

Let’s talk specifics. Here are some of the standout features that make Conns Payments a must-have:

- Automated Payments: Set it and forget it. Schedule payments in advance and never worry about missing a deadline again.

- Real-Time Tracking: Keep tabs on your transactions as they happen. No more guessing whether a payment went through.

- Multi-Account Management: Handle all your accounts from one central location. Simplify your financial life with ease.

- Security Features: With advanced encryption and fraud detection, your data is protected at all times.

- Custom Alerts: Get notified about upcoming bills, payment confirmations, and more. Stay in control of your finances.

Benefits of Using Conns Payments

So, what’s in it for you? The benefits of using Conns Payments are plenty. For starters, it saves you time. Instead of spending hours each month on manual payments, you can automate the process and free up valuable time for other things. And let’s not forget the peace of mind that comes with knowing your finances are in order.

Another huge advantage is the cost savings. By automating payments and setting up reminders, you can avoid those pesky late fees that add up over time. Plus, Conns Payments offers competitive rates and fees, ensuring that you’re not overpaying for convenience. It’s a win-win situation all around.

Who Can Benefit from Conns Payments?

Let’s be real, Conns Payments isn’t just for one specific group of people. Whether you’re a small business owner, a busy professional, or a stay-at-home parent, this platform can make your life easier. Here’s how:

- Small Business Owners: Streamline your business finances with automated invoicing and payment tracking.

- Professionals: Save time and reduce stress by automating personal and work-related payments.

- Families: Keep household finances in check with easy-to-use tools and real-time updates.

Conns Payments vs. Traditional Methods

Let’s compare Conns Payments to traditional payment methods. In the old days, managing payments meant dealing with stacks of paper bills, writing checks, and hoping they cleared on time. Not exactly the most efficient system, right? Conns Payments changes all that by bringing payments into the digital age.

With Conns Payments, you can say goodbye to paper clutter and hello to a streamlined digital experience. Everything from bill payments to credit management is handled in one easy-to-use platform. Plus, the added security features ensure that your sensitive information stays protected. It’s like trading in your old flip phone for a shiny new smartphone.

Security Measures in Conns Payments

Security is a top priority for Conns Payments. The platform employs advanced encryption to safeguard your data, ensuring that your financial info is protected at all times. Additionally, fraud detection systems are in place to catch any suspicious activity before it becomes a problem.

But that’s not all. Conns Payments also offers two-factor authentication, adding an extra layer of protection to your account. This means even if someone gets hold of your password, they won’t be able to access your account without the second form of verification. It’s like having a personal bodyguard for your finances.

Common Questions About Conns Payments

Got questions? We’ve got answers. Here are some of the most frequently asked questions about Conns Payments:

- Is Conns Payments free? While there’s no upfront cost to use the platform, certain features may come with fees. Be sure to check the terms and conditions for full details.

- Can I use Conns Payments internationally? Currently, Conns Payments is primarily available in the U.S., but they’re always exploring new markets.

- What happens if I miss a payment? Don’t sweat it. Conns Payments offers flexible options for rescheduling missed payments and avoiding late fees.

How to Get Started with Conns Payments

Ready to take the plunge? Getting started with Conns Payments is super easy. Just head over to their website, sign up for an account, and link your financial info. Once you’re all set up, you can start enjoying the benefits of seamless payment management. It’s like signing up for a gym membership, but instead of working out, you’re working on your finances.

Testimonials and Success Stories

Don’t just take my word for it. Here’s what some happy users have to say about Conns Payments:

“I used to dread paying bills every month, but Conns Payments has completely changed the game. Now I can handle everything in one place, and I’ve even saved money on late fees. It’s a lifesaver!” – Sarah M.

“As a small business owner, managing payments was always a headache. Conns Payments has made the process so much easier, freeing up time for me to focus on growing my business.” – John T.

Expert Insights on Conns Payments

According to financial experts, Conns Payments is setting a new standard in the payment solutions industry. Its combination of convenience, security, and affordability makes it a top choice for both businesses and individuals. As one expert put it, “Conns Payments is exactly what the financial world needed—a platform that simplifies payments without compromising on security.”

Conclusion: Why Conns Payments is Worth It

Let’s wrap it up. Conns Payments isn’t just another payment platform; it’s a game-changer that can transform how you handle your finances. With features like automated payments, real-time tracking, and top-notch security, it’s no wonder people are raving about it. Whether you’re a business owner or someone managing personal expenses, Conns Payments offers a solution that’s both efficient and reliable.

So, what are you waiting for? Take control of your financial future and give Conns Payments a try. And don’t forget to share this article with your friends and family. Who knows, you might just help them simplify their lives too. Until next time, keep your finances in check and your wallet happy!

Table of Contents

- What Are Conns Payments?

- How Conns Payments Works

- Why Choose Conns Payments?

- Key Features of Conns Payments

- Benefits of Using Conns Payments

- Conns Payments vs. Traditional Methods

- Security Measures in Conns Payments

- Common Questions About Conns Payments

- How to Get Started with Conns Payments

- Testimonials and Success Stories

Hisense Conn's

Conn's Logo PNG Transparent & SVG Vector Freebie Supply

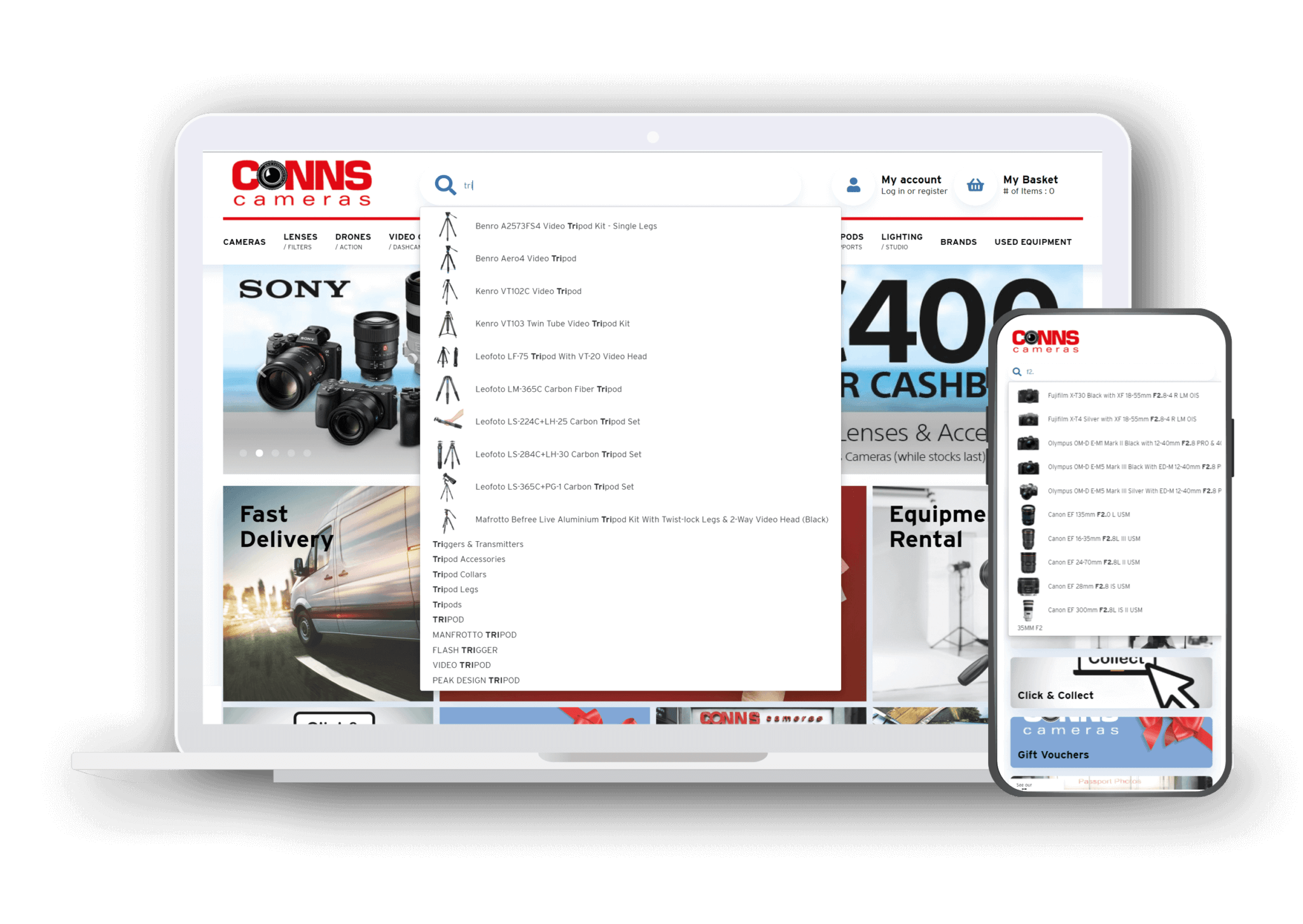

Conns Cameras Makes Finding Complicated Product Names Simple With