Dave Ramsey Excel Spreadsheet Budget: Your Ultimate Guide To Financial Freedom

So, you've heard about Dave Ramsey's Excel spreadsheet budget, huh? Let's dive right into it. If you're here, chances are you're looking for a way to take control of your finances and build a solid financial foundation. Dave Ramsey's budgeting method is like the secret sauce to financial peace, and using an Excel spreadsheet can make the whole process smoother than butter. Whether you're a beginner or already familiar with budgeting, this guide will help you master the art of financial planning.

Now, why is everyone talking about Dave Ramsey's budgeting strategy? Well, it's not just some random idea thrown out there. This guy's got a proven track record of helping people get out of debt, save money, and achieve financial independence. His Excel spreadsheet budget is like the ultimate tool to organize your financial life. Imagine having all your expenses, income, and goals neatly laid out in one place. Sounds dreamy, right?

Before we dive deeper, let's set the stage. Budgeting might sound boring to some, but trust me, it's the key to unlocking your financial potential. With Dave Ramsey's approach, you'll learn how to prioritize your spending, cut unnecessary expenses, and focus on what truly matters. And hey, using Excel makes it even easier to track your progress and adjust as needed. So, grab your coffee, and let's get started!

What is Dave Ramsey's Excel Spreadsheet Budget All About?

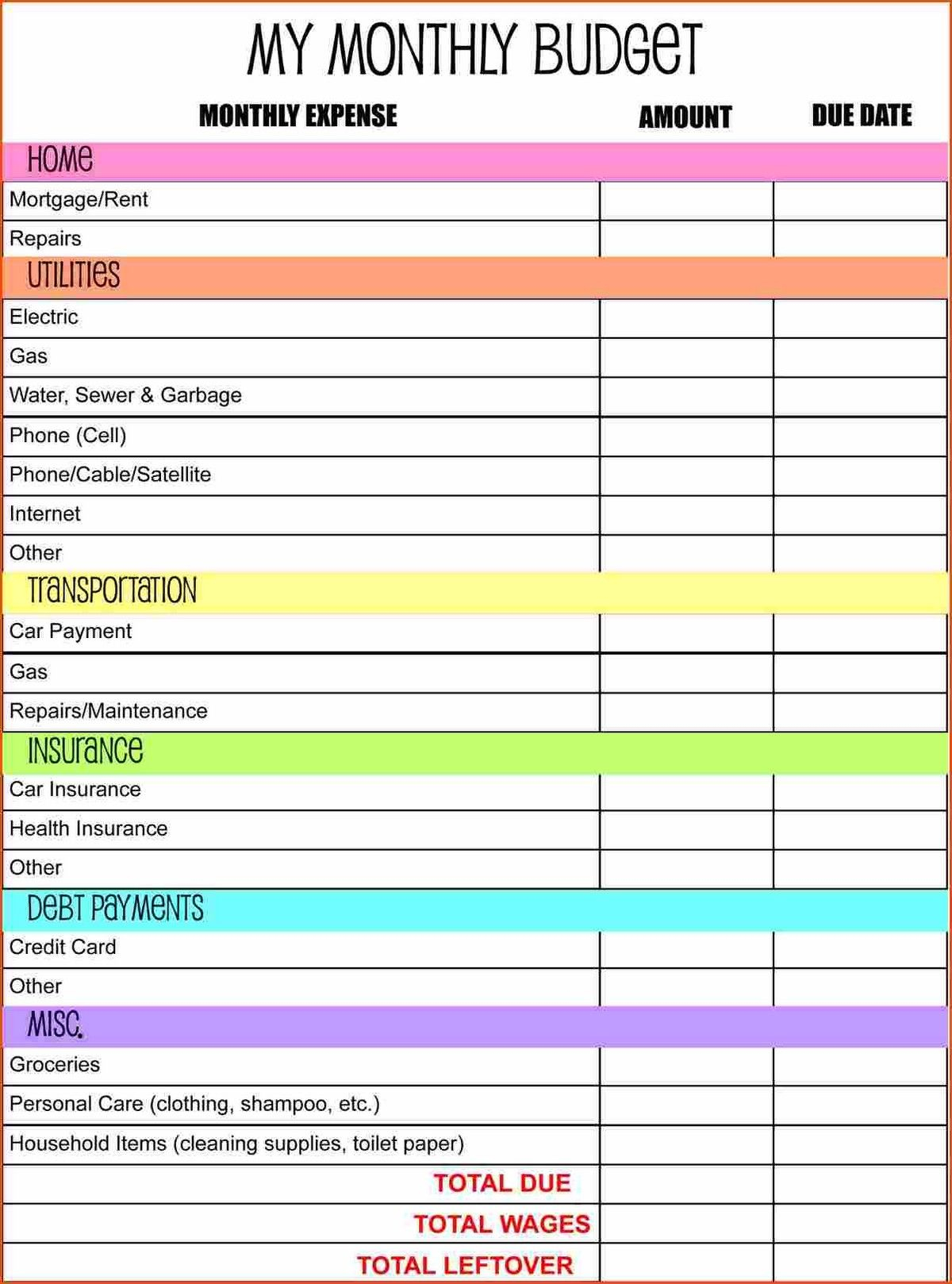

Dave Ramsey's Excel spreadsheet budget is essentially a digital version of his tried-and-true envelope system. Think of it as a virtual wallet where you allocate your money for different categories like housing, groceries, entertainment, and savings. The beauty of using Excel is that it allows you to customize your budget based on your unique financial situation. Plus, it's super easy to update and tweak as your financial goals evolve.

One of the coolest things about this spreadsheet is that it helps you stick to your budget. You won't accidentally overspend because everything is laid out clearly in front of you. It's like having a financial coach sitting right next to you, keeping you accountable every step of the way. And let's be honest, who doesn't need a little accountability when it comes to money?

Why Use an Excel Spreadsheet for Budgeting?

There are plenty of budgeting apps out there, but Excel spreadsheets have their own charm. For starters, they're incredibly flexible. You can add, remove, or modify categories as needed without being locked into a rigid system. Plus, Excel is free if you're using platforms like Google Sheets, which means you won't have to spend a dime on software. And if you're already familiar with Excel, you'll feel right at home.

Another advantage of using Excel is that it's offline-friendly. You don't need an internet connection to access your budget, which is perfect if you're traveling or in areas with spotty Wi-Fi. Additionally, Excel allows you to create complex formulas and charts, giving you a visual representation of your financial health. Who knew budgeting could be so visually appealing?

How to Set Up Your Dave Ramsey Excel Spreadsheet Budget

Setting up your budget might seem daunting at first, but trust me, it's easier than you think. Here's a step-by-step guide to help you get started:

First things first, download a Dave Ramsey budget template from a trusted source. There are plenty of free templates available online that are already pre-formatted for you. Once you've got your template, open it in Excel or Google Sheets and take a moment to familiarize yourself with its layout.

Next, input your monthly income. This includes your salary, side hustle earnings, and any other sources of income. Be as accurate as possible to ensure your budget reflects your true financial picture. After that, list all your monthly expenses. Start with fixed expenses like rent or mortgage, utilities, and insurance, then move on to variable expenses like groceries, entertainment, and dining out.

Tips for Customizing Your Budget

- Use color-coding to differentiate between categories. For example, use green for savings and red for debt payments.

- Create subcategories for expenses that require more detail. For instance, under groceries, you might want to break it down further into produce, meat, and snacks.

- Add a "miscellaneous" category for unexpected expenses. This will help prevent your budget from being thrown off by surprise costs.

Customizing your budget ensures it works for you and not the other way around. Remember, your budget should be a reflection of your financial goals and priorities. So, don't be afraid to tweak it until it feels just right.

Understanding Dave Ramsey's Financial Philosophy

Before we dive deeper into the spreadsheet itself, let's talk about Dave Ramsey's financial philosophy. His approach is built on the foundation of the "Total Money Makeover," which emphasizes debt elimination, saving for emergencies, and building wealth over time. One of his core principles is the "baby steps," a step-by-step plan to financial freedom.

The baby steps start with saving $1,000 for an emergency fund, then paying off all debt except for your mortgage using the debt snowball method. Once you're debt-free, you focus on saving three to six months' worth of expenses, investing for retirement, and eventually building wealth. It's a simple yet powerful plan that has helped millions of people transform their financial lives.

How Does the Spreadsheet Fit into the Baby Steps?

The Excel spreadsheet is like the backbone of the baby steps. It helps you track your progress as you move from one step to the next. For example, if you're on baby step two, paying off debt, the spreadsheet allows you to see exactly how much you owe and how much you're paying off each month. This visibility keeps you motivated and on track to achieve your financial goals.

Additionally, the spreadsheet helps you allocate funds for each baby step. You can clearly see how much money is going towards debt repayment, saving, and investing. It's like having a financial dashboard that gives you a 360-degree view of your financial health.

Maximizing Your Dave Ramsey Excel Spreadsheet Budget

Now that you've set up your spreadsheet, it's time to make the most of it. Here are some tips to help you maximize its potential:

First, update your budget regularly. Whether it's weekly or monthly, make it a habit to review your expenses and adjust your categories as needed. This ensures your budget stays relevant and aligned with your financial goals. Also, don't be afraid to experiment with different allocation strategies. Maybe you want to allocate more to savings one month or cut back on entertainment to pay off debt faster.

Another great tip is to use formulas to automate calculations. For example, you can use the SUM function to automatically calculate your total income and expenses. This saves you time and reduces the risk of manual errors. Additionally, consider adding charts or graphs to visualize your progress. Seeing your debt decrease or your savings grow can be incredibly motivating.

Common Mistakes to Avoid

- Not updating your budget regularly. This can lead to overspending and missed opportunities to adjust your financial strategy.

- Underestimating expenses. Make sure you account for all your expenses, even the small ones. They can add up quickly!

- Forgetting to save. Even if it's just a small amount, make sure you're setting aside money for emergencies and future goals.

Avoiding these common pitfalls will help you stay on track and make the most of your budgeting efforts.

Real-Life Success Stories

Let's talk about some real-life success stories of people who have used Dave Ramsey's Excel spreadsheet budget to achieve financial freedom. Sarah, a single mom from Texas, was drowning in debt but managed to pay off $50,000 in just three years using the spreadsheet. She credits the visibility and accountability the spreadsheet provided for her success.

Then there's John, a software engineer from California, who used the spreadsheet to save enough money to buy a house in cash. He says the spreadsheet helped him stay focused on his goal and avoid unnecessary expenses. Stories like these are proof that Dave Ramsey's method works when paired with the right tools.

How Can You Achieve Similar Success?

The key to achieving similar success is consistency and discipline. Stick to your budget, review it regularly, and make adjustments as needed. Surround yourself with a supportive community, whether it's online forums or local meetups, where you can share tips and encouragement. Remember, financial freedom is a journey, and the spreadsheet is just one tool to help you get there.

Resources and Tools to Enhance Your Budgeting Experience

While the Excel spreadsheet is a powerful tool, there are other resources and tools you can use to enhance your budgeting experience. Apps like YNAB (You Need a Budget) and Mint offer additional features like automated bill tracking and expense categorization. These can complement your spreadsheet and give you even more control over your finances.

Additionally, consider attending a Dave Ramsey Financial Peace University class. These classes provide in-depth training on budgeting, debt elimination, and wealth building. They also offer a supportive community where you can connect with others on the same financial journey.

How to Stay Motivated on Your Financial Journey

Staying motivated can be challenging, but there are ways to keep yourself inspired. Celebrate small wins along the way, whether it's paying off a credit card or reaching a savings milestone. Surround yourself with positive influences, like motivational podcasts or books on personal finance. And remember, progress is progress, no matter how small.

Conclusion: Take Control of Your Finances Today

So, there you have it, the ultimate guide to Dave Ramsey's Excel spreadsheet budget. Whether you're just starting out or looking to refine your budgeting skills, this tool can help you achieve financial freedom. Remember, the key to success is consistency, discipline, and using the right resources.

Now, it's your turn to take action. Download a budget template, input your numbers, and start tracking your progress. Share this article with friends and family who might benefit from it, and don't forget to leave a comment below with your thoughts and experiences. Together, we can create a community of financially empowered individuals.

Table of Contents

- What is Dave Ramsey's Excel Spreadsheet Budget All About?

- Why Use an Excel Spreadsheet for Budgeting?

- How to Set Up Your Dave Ramsey Excel Spreadsheet Budget

- Tips for Customizing Your Budget

- Understanding Dave Ramsey's Financial Philosophy

- How Does the Spreadsheet Fit into the Baby Steps?

- Maximizing Your Dave Ramsey Excel Spreadsheet Budget

- Common Mistakes to Avoid

- Real-Life Success Stories

- How Can You Achieve Similar Success?

- Resources and Tools to Enhance Your Budgeting Experience

- How to Stay Motivated on Your Financial Journey

- Conclusion: Take Control of Your Finances Today

Dave Ramsey Budget Spreadsheet Template Db Excel Printable Worksheets

Dave Ramsey Budget Spreadsheet Or Printable Bud Worksheet Dave

Dave Ramsey Inspired Excel Budget Spreadsheet for Excel Auto Filled