Pay Real Estate Taxes Online Miami Dade: A Simple Guide For Smart Homeowners

Let’s face it, folks—paying real estate taxes is one of those inevitable parts of life, like death and… well, taxes. But here’s the good news: in Miami-Dade County, you don’t have to spend hours standing in line at some dusty government office. Nope, you can pay real estate taxes online Miami Dade, right from the comfort of your living room—or wherever you happen to be sipping your morning coffee. It’s quick, easy, and surprisingly painless if you know what you’re doing.

Now, I get it. Taxes can feel like this big, scary monster that you’d rather avoid at all costs. But trust me, paying your real estate taxes online Miami Dade is a game-changer. It’s not just about convenience—it’s about saving time, reducing stress, and staying on top of your finances. Plus, who doesn’t love the feeling of ticking off a major responsibility from their to-do list without leaving the house?

So, buckle up, buttercup, because we’re about to dive deep into everything you need to know about paying real estate taxes online in Miami-Dade. By the end of this article, you’ll be an expert, ready to tackle your property tax payments with confidence. Let’s do this!

Table of Contents

- Understanding Real Estate Taxes in Miami-Dade

- Why Pay Real Estate Taxes Online?

- Step-by-Step Guide to Paying Online

- Benefits of Online Payment

- Important Deadlines to Know

- Common Questions About Paying Real Estate Taxes

- Tips for a Smooth Transaction

- Useful Resources for Miami-Dade Property Owners

- Is Paying Online Secure?

- The Future of Property Tax Payments

Understanding Real Estate Taxes in Miami-Dade

Alright, let’s break it down. Real estate taxes, also known as property taxes, are basically the fees you pay to the local government for the privilege of owning a piece of land or a building. In Miami-Dade County, these taxes fund essential services like schools, police departments, fire stations, and public infrastructure. Think of it as your contribution to keeping the community running smoothly.

How Are Property Taxes Calculated?

Property taxes in Miami-Dade are calculated based on your property’s assessed value. The county’s Property Appraiser determines this value annually, taking into account factors like location, size, and improvements. Once they’ve got that number, they multiply it by the tax rate, which is set by the local government.

For example, if your home is assessed at $300,000 and the tax rate is 1.5%, your annual property tax bill would be around $4,500. Easy peasy, right? Well, kinda.

Why Pay Real Estate Taxes Online?

Listen up, because this is where things get interesting. Paying real estate taxes online Miami Dade isn’t just a fancy option—it’s a no-brainer. Here’s why:

- Convenience: No more waiting in long lines or dealing with office hours. You can pay anytime, anywhere.

- Speed: Online payments are processed almost instantly, so you don’t have to worry about checks getting lost in the mail.

- Accuracy: With online systems, you can double-check your account details and ensure everything is correct before submitting your payment.

- Peace of Mind: Once you’ve paid, you’ll receive a digital receipt that you can save or print for your records.

And hey, who doesn’t love cutting out the middleman? Paying online means fewer steps, less hassle, and more time for the important stuff—like binge-watching your favorite show or planning your next Miami adventure.

Step-by-Step Guide to Paying Online

Okay, let’s get practical. Here’s how you can pay your real estate taxes online Miami Dade in just a few simple steps:

Step 1: Gather Your Info

Before you start, make sure you’ve got all the necessary details handy. This includes:

- Your property tax bill or notice

- Your property parcel ID number

- A valid credit or debit card (or your bank account info for e-check payments)

Step 2: Visit the Official Website

Head over to the Miami-Dade County Property Tax Collector’s website. It’s secure, user-friendly, and specifically designed to help property owners like you make payments easily.

Step 3: Enter Your Parcel ID

Once you’re on the site, enter your property parcel ID number to access your account. If you don’t know your parcel ID, don’t panic—you can look it up using your address.

Step 4: Review Your Bill

Take a moment to review your bill carefully. Make sure all the numbers add up and everything looks correct. If you spot any errors, contact the Property Tax Collector’s office immediately.

Step 5: Choose Your Payment Method

Select your preferred payment method—credit/debit card or e-check—and follow the prompts to complete your transaction. And just like that, you’re done!

Benefits of Online Payment

Now that we’ve covered the basics, let’s talk about the perks. Paying real estate taxes online Miami Dade offers a ton of benefits beyond convenience. Here are a few more reasons to make the switch:

- No Late Fees: Online payments are processed quickly, reducing the risk of late payments and penalties.

- Environmentally Friendly: By going digital, you’re helping reduce paper waste and contribute to a greener planet.

- Access to Records: You can easily access your payment history and tax records anytime you need them.

- Customer Support: Most online platforms offer 24/7 support in case you run into any issues.

Plus, who doesn’t love the satisfaction of crossing something off their to-do list without leaving the couch? Seriously, it’s a win-win.

Important Deadlines to Know

Deadlines are serious business when it comes to real estate taxes. In Miami-Dade, property taxes are typically due in November, but there are early payment discounts available if you pay by a certain date. Here’s a quick breakdown:

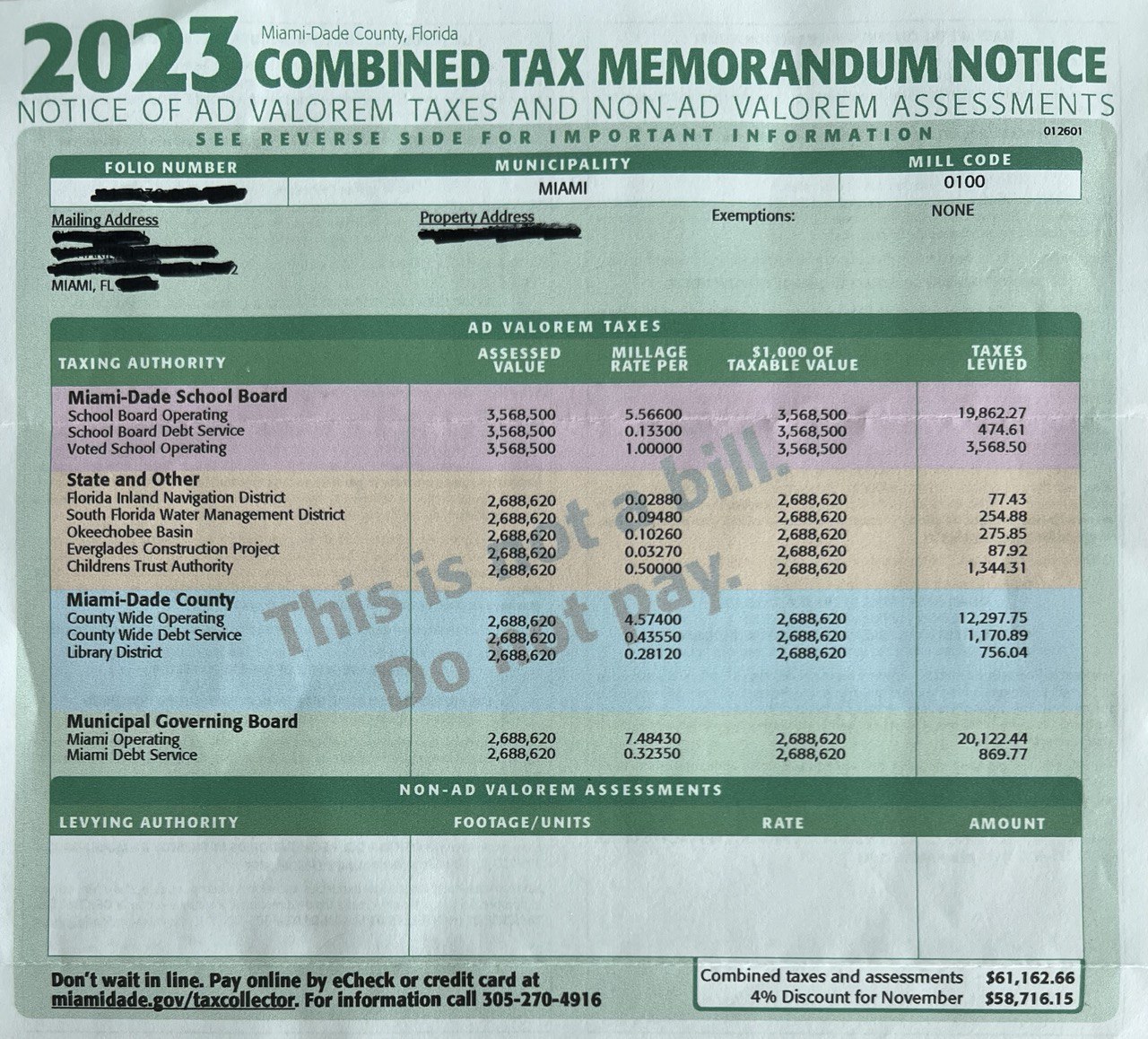

- Early Payment Discount: Pay by October 31st to receive a 4% discount on your tax bill.

- Due Date: November 1st is the official due date for property taxes.

- Late Payment Penalties: Payments made after December 31st will incur late fees and interest charges.

Pro tip: Set reminders on your phone or calendar so you never miss a deadline. Trust me, your wallet will thank you later.

Common Questions About Paying Real Estate Taxes

Got questions? Don’t worry—we’ve got answers. Here are some of the most common queries about paying real estate taxes online Miami Dade:

Q: Can I pay partial amounts online?

A: Yes, you can pay partial amounts if you’re unable to cover the full bill at once. Just be aware that any remaining balance will accrue interest if not paid by the deadline.

Q: Are there fees for online payments?

A: There may be small convenience fees for credit/debit card payments, but e-check payments are usually free. Check the website for the latest fee schedule.

Q: What if I can’t afford to pay my taxes?

A: Miami-Dade offers hardship programs and payment plans for qualifying property owners. Reach out to the Property Tax Collector’s office for more information.

Tips for a Smooth Transaction

Ready to pay your real estate taxes online Miami Dade? Here are a few tips to ensure a smooth and stress-free experience:

- Double-check your parcel ID and account details before submitting your payment.

- Save or print your digital receipt for your records.

- Pay early if possible to avoid last-minute rush and potential technical issues.

- Stay organized by keeping all your tax documents in one place.

Remember, preparation is key. The more organized you are, the smoother the process will be.

Useful Resources for Miami-Dade Property Owners

Here are some handy resources to help you navigate the world of real estate taxes in Miami-Dade:

- Miami-Dade County Property Tax Collector’s Website

- Miami-Dade County Property Appraiser’s Office

- Miami-Dade County Customer Service Hotline: (305) 375-4728

These sites offer a wealth of information, from tax calculators to FAQs, so don’t hesitate to explore them further.

Is Paying Online Secure?

Security is always a concern when it comes to online transactions, but rest assured, the Miami-Dade County Property Tax Collector’s website uses state-of-the-art encryption technology to protect your personal and financial information. That means your data is safe, secure, and private.

Still skeptical? You can always reach out to the Property Tax Collector’s office if you have any concerns or questions about their security measures. Better safe than sorry, right?

The Future of Property Tax Payments

As technology continues to evolve, so do the ways we handle our finances. Paying real estate taxes online Miami Dade is just the beginning. In the future, we may see even more advanced systems, like mobile apps, AI-powered chatbots, and blockchain-based payment solutions.

For now, though, embracing online payment options is a great way to stay ahead of the curve and simplify your life. Who knows—maybe someday paying taxes will actually be fun. Okay, maybe not fun, but definitely less painful.

Conclusion

There you have it, folks—a comprehensive guide to paying real estate taxes online Miami Dade. Whether you’re a seasoned homeowner or a first-time property owner, this process is your ticket to stress-free tax payments. Remember, the key is preparation, organization, and staying informed.

So, what are you waiting for? Head over to the Miami-Dade County Property Tax Collector’s website and get started today. And when you’re done, don’t forget to share this article with your fellow homeowners. Together, we can make paying taxes a little less daunting—one click at a time.

Got thoughts, questions, or tips of your own? Drop a comment below or hit me up on social media. Let’s keep the conversation going!

HOW TO pay your property taxes online One of the most convenient ways

Understanding Your Miami Florida Real Estate Taxes Hauseit®

Miami Dade Tax Estimator