Sig Rewards: The Ultimate Guide To Boosting Your Financial Rewards Today

Have you ever wondered how to make your money work harder for you? Sig Rewards might just be the answer you're looking for. Whether you're a savvy investor or someone who wants to maximize their earning potential, sig rewards can offer incredible opportunities. This isn't just another buzzword in the financial world; it's a game-changer that could transform the way you approach personal finance.

Let’s face it, life gets expensive. From groceries to utility bills, it seems like there's always something eating away at our wallets. But what if I told you there’s a way to turn those everyday expenses into opportunities for growth? Sig rewards are designed to do exactly that – turning ordinary transactions into extraordinary gains. So, if you're ready to take control of your finances, keep reading because we’ve got all the juicy details you need.

In this article, we'll dive deep into sig rewards – what they are, how they work, and why they matter. Whether you're new to the concept or looking to expand your knowledge, this guide will give you everything you need to know. Let's get started!

Table of Contents

- What Are Sig Rewards?

- How Do Sig Rewards Work?

- Benefits of Sig Rewards

- Types of Sig Rewards

- Eligibility for Sig Rewards

- Getting Started with Sig Rewards

- Common Mistakes to Avoid

- Maximizing Your Sig Rewards

- Real-Life Stories

- Future of Sig Rewards

What Are Sig Rewards?

Alright, let’s break it down. Sig rewards are essentially a system that rewards users for specific actions or behaviors. These rewards can come in various forms, from cashback to points that can be redeemed for goods and services. They're designed to incentivize users to engage more with a platform, service, or product. Think of it as a modern-day loyalty program on steroids.

But here's the kicker – sig rewards aren't just about earning points. They're about creating value. By participating in sig reward programs, you're not only earning back some of the money you spend but also gaining access to exclusive offers and perks. It's like getting a backstage pass to the financial world, except instead of meeting your favorite band, you're boosting your bank account.

In today's competitive market, companies are constantly looking for ways to keep their customers engaged. Sig rewards provide a win-win situation for both parties. Users get rewarded for their loyalty, while businesses see increased engagement and retention. It's a match made in heaven, folks!

Defining Sig Rewards

Now, let’s get a little technical. Sig rewards are typically tied to specific platforms or services. For example, a credit card company might offer sig rewards for every purchase made using their card. These rewards can accumulate over time, giving users more purchasing power or financial benefits. It's kind of like leveling up in a video game, except instead of gaining experience points, you're gaining financial rewards.

And guess what? The possibilities are endless. Some sig reward programs allow users to redeem their points for travel, while others offer discounts on everyday purchases. The key is to find the program that aligns with your lifestyle and financial goals. So, whether you're a frequent traveler or a bargain hunter, there's something out there for everyone.

How Do Sig Rewards Work?

So, how exactly do sig rewards work? It's simpler than you might think. First, you need to sign up for a sig reward program. This could be through a credit card provider, a retail store, or even an online platform. Once you're enrolled, every eligible transaction you make earns you points or cashback. It's like magic, but with numbers!

But wait, there's more. Some programs offer bonus rewards for specific categories or during certain times of the year. For example, you might earn double points on dining expenses during the holiday season. It's like a treasure hunt, except the treasure is financial rewards. Pretty cool, right?

Another important aspect of sig rewards is the redemption process. Once you've accumulated enough points, you can redeem them for various rewards. This could be anything from gift cards to travel vouchers. The key is to plan ahead and make the most of your rewards. After all, why let those points sit idle when they could be working for you?

Earning and Redemption Process

Let’s talk about the nitty-gritty of earning and redeeming sig rewards. First, you need to understand the earning structure. Some programs offer a flat rate for all transactions, while others have tiered systems based on spending levels. It's important to choose a program that suits your spending habits.

When it comes to redemption, there are a few things to keep in mind. Some programs have expiration dates for rewards, so you'll need to use them before they expire. Others might have restrictions on where or how you can redeem your rewards. It's like playing a game – you need to know the rules to win!

And let’s not forget about the fine print. Always read the terms and conditions of any sig reward program you join. There might be hidden fees or limitations that could affect your overall experience. Knowledge is power, and in this case, it's also money!

Benefits of Sig Rewards

Now that we know what sig rewards are and how they work, let’s talk about the benefits. First and foremost, sig rewards can help you save money. By earning points or cashback on everyday purchases, you're effectively reducing your overall spending. It's like getting a discount on everything you buy!

But the benefits don't stop there. Sig rewards can also help you achieve your financial goals faster. Whether you're saving for a vacation or paying off debt, these rewards can provide an extra boost to your efforts. It's like having a financial cheerleader in your corner, pushing you to succeed.

And let’s not underestimate the convenience factor. With sig rewards, you don't have to go out of your way to earn or redeem rewards. Everything is done automatically, making it easy to incorporate into your daily routine. In today's fast-paced world, convenience is key!

Financial Growth Through Sig Rewards

One of the most exciting aspects of sig rewards is their potential for financial growth. By consistently earning and redeeming rewards, you can build a solid financial foundation. Think of it as planting a tree – the more you nurture it, the bigger it grows.

And here's another bonus – sig rewards can help you discover new opportunities. For example, you might find a great deal on a flight or a hotel stay through your reward program. It's like opening a treasure chest full of surprises. Who doesn't love that?

So, whether you're looking to save money, achieve financial goals, or simply enjoy the convenience of automatic rewards, sig rewards have something to offer. It's a no-brainer, really!

Types of Sig Rewards

Not all sig rewards are created equal. There are several types of sig rewards, each with its own set of benefits and drawbacks. Let’s take a look at some of the most popular options.

- Cashback Rewards: These rewards give you a percentage of your spending back in cash. It's like getting a refund on your purchases!

- Points-Based Rewards: These rewards allow you to earn points that can be redeemed for various goods and services. Think of it as a loyalty program on steroids.

- Travel Rewards: These rewards are perfect for frequent travelers. They offer perks like free flights, hotel stays, and more.

- Exclusive Offers: Some sig reward programs offer exclusive deals and discounts that aren't available to the general public. It's like having a secret club membership!

Choosing the right type of sig reward program depends on your personal preferences and financial goals. For example, if you're a frequent traveler, a travel rewards program might be the best option for you. On the other hand, if you prefer cashback, a points-based system might be more suitable.

Selecting the Right Sig Rewards

When selecting a sig reward program, it's important to consider a few factors. First, think about your spending habits. Are you a big spender or more of a budget-conscious individual? This will help you determine which program will give you the most value.

Next, consider the redemption options. Do you want cashback, points, or travel rewards? Each option has its own set of benefits, so choose wisely. And don't forget to read the fine print – you don't want any unpleasant surprises down the road!

Finally, think about the overall value of the program. Some programs might offer high earning rates but have steep redemption requirements. Others might have lower earning rates but easier redemption options. It's all about finding the right balance for your needs.

Eligibility for Sig Rewards

Not everyone is eligible for sig rewards. Most programs have specific requirements that you need to meet before you can start earning rewards. These requirements can vary depending on the program, so it's important to check the details carefully.

Some common eligibility criteria include age restrictions, residency requirements, and minimum spending thresholds. For example, you might need to be over 18 years old and a resident of a specific country to participate. Additionally, some programs require a minimum spending amount before you start earning rewards.

It's also worth noting that some programs have exclusions. Certain types of transactions or purchases might not qualify for rewards. It's like playing a game with specific rules – you need to know them to win!

Meeting Eligibility Requirements

To meet the eligibility requirements for sig rewards, you'll need to do a little homework. First, check the program's website for detailed information on their requirements. Make sure you meet all the criteria before signing up.

Next, consider any exclusions or limitations. Are there any transactions or purchases that won't qualify for rewards? This is important to know so you can plan your spending accordingly. And don't forget to keep track of your rewards – you don't want to miss out on any opportunities!

Finally, be aware of any changes to the program's terms and conditions. Programs can update their rules at any time, so it's important to stay informed. Knowledge is power, and in this case, it's also money!

Getting Started with Sig Rewards

Ready to dive into the world of sig rewards? Here's how you can get started. First, do some research to find the right program for you. Consider your spending habits, financial goals, and preferences. Once you've found a program that suits your needs, sign up and start earning rewards!

But wait, there's more. To make the most of your sig rewards, you'll need to stay organized. Keep track of your rewards, redemption options, and any program updates. It's like having a financial planner in your pocket – except it's free!

And don't forget to have fun with it. Sig rewards are a great way to make your money work harder for you, but they're also a fun way to engage with your finances. So, whether you're earning points, cashback, or travel rewards, enjoy the process and watch your savings grow!

Tips for Maximizing Sig Rewards

Here are a few tips to help you maximize your sig rewards:

- Stay Organized: Keep track of your rewards and redemption options to make the most of them.

- Plan Ahead: Use your rewards strategically to achieve your financial goals.

- Read the Fine Print: Make sure you understand the terms and conditions of your reward program.

- Explore Options: Don't be afraid to try different programs to find the one that suits you best.

By following these tips, you'll be well on your way to maximizing your sig rewards and boosting your financial well-being. It's like leveling up in life – except this time, you're leveling up your bank account!

Common

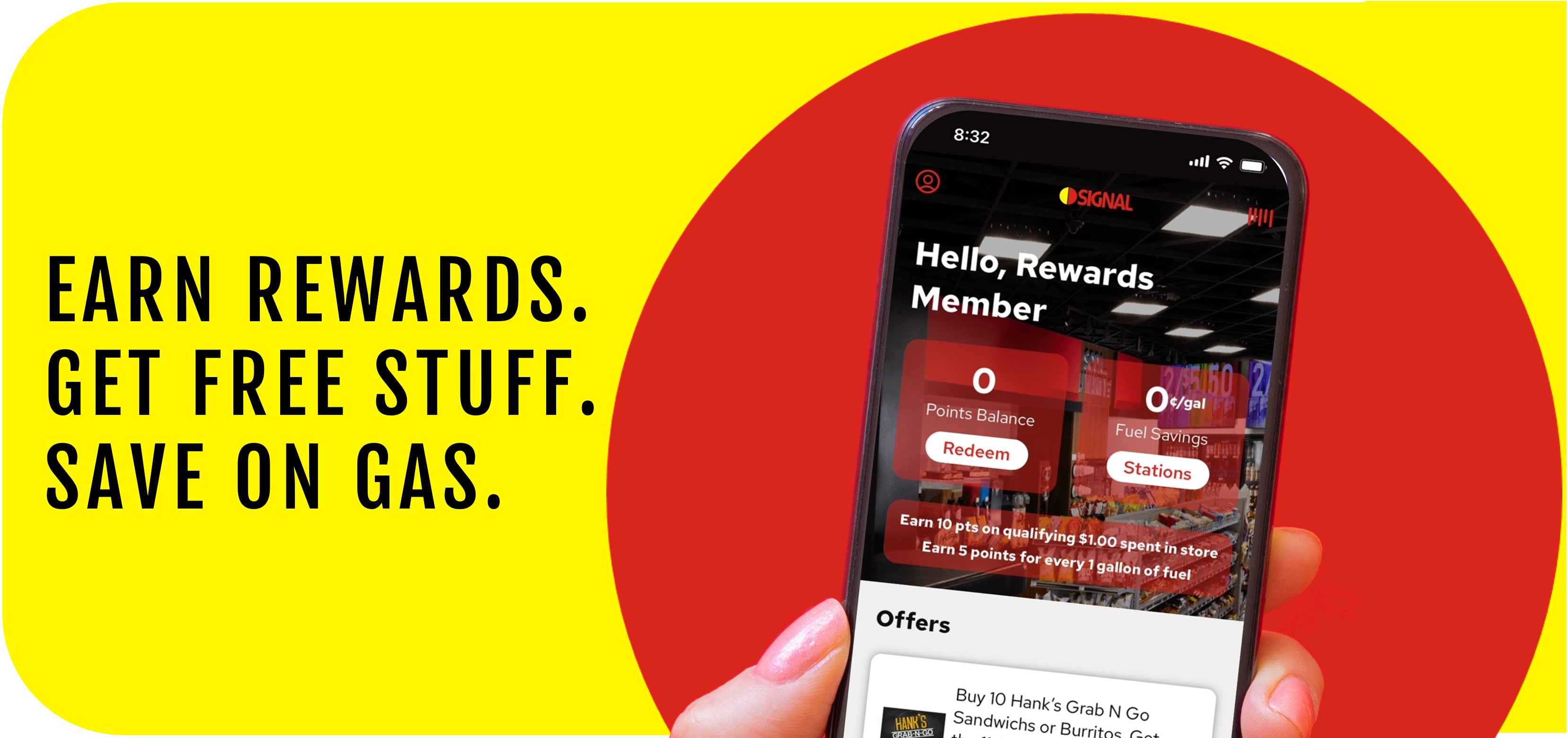

Rewards Signal

Rewards Signal

RifleGear Earn 50 in SIG Store Rewards with any P320...