FintechZoom: Apple Stock Price Prediction - What’s Next For The Tech Giant?

Hey there, stock enthusiasts! If you’ve been keeping tabs on the financial world, you’ve probably noticed the buzz around Apple stock price prediction. It’s like a rollercoaster ride—exciting, unpredictable, and full of surprises. Whether you're a seasoned investor or just dipping your toes into the fintech pool, understanding Apple’s stock movement is crucial. So, let’s dive in and figure out what the future holds for this tech titan!

Apple has always been a big deal in the tech industry, but its stock price prediction has become a hot topic lately. With its massive market presence and innovative products, it’s no wonder investors are eager to know where the stock is headed. But here’s the deal—predicting stock prices isn’t as simple as flipping a coin. It involves analyzing data, understanding market trends, and sometimes, a little bit of gut feeling.

This article isn’t just about throwing numbers at you. We’re going to break down the factors that influence Apple’s stock price, explore expert predictions, and give you insights to help you make informed decisions. So, buckle up because we’re about to zoom into the world of fintech and Apple stock!

Understanding FintechZoom: A Quick Overview

Before we get into the nitty-gritty of Apple stock price prediction, let’s talk about FintechZoom. It’s not just another financial platform; it’s your go-to spot for all things fintech. From stock market analysis to investment tips, FintechZoom has got you covered. Think of it as your personal finance guru, helping you navigate the complex world of investments.

FintechZoom uses advanced algorithms and data analytics to provide users with real-time insights into stock performance. It’s like having a crystal ball that shows you potential market trends. But remember, even the best tools can’t guarantee success. Investing always comes with risks, and it’s essential to do your homework before jumping in.

Why FintechZoom Matters for Investors

- Real-time data analysis for better decision-making

- Expert insights and market trend predictions

- Customizable investment strategies tailored to your goals

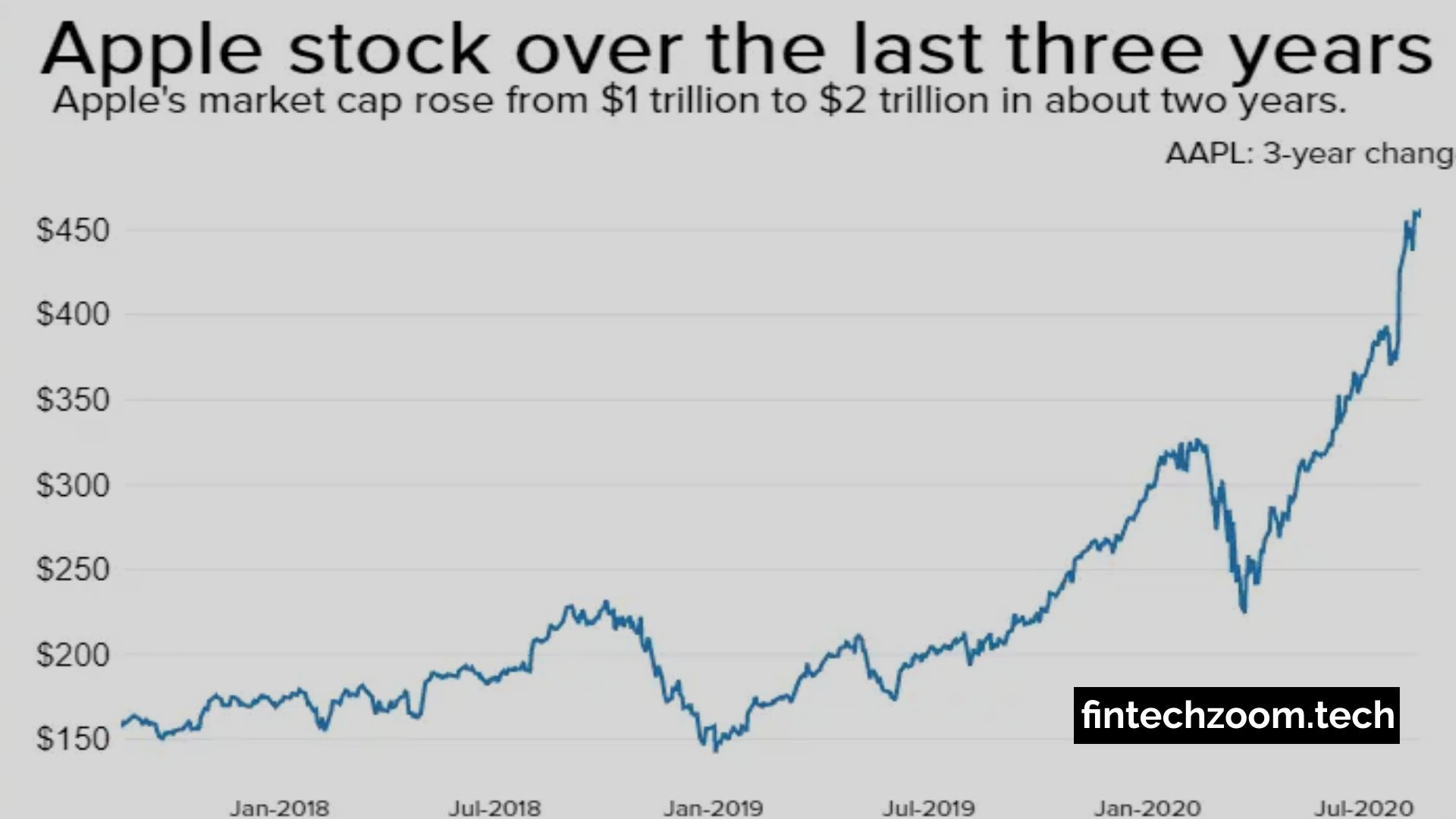

Apple’s Stock Price: A Historical Perspective

Let’s rewind a bit and take a look at Apple’s stock journey. Over the years, Apple has seen its fair share of ups and downs. From its humble beginnings to becoming the world’s most valuable company, Apple’s stock price has been a fascinating study in market dynamics. Understanding its historical performance can give us clues about its future trajectory.

Back in the early 2000s, Apple was trading at a fraction of its current value. Fast forward to today, and it’s a different story altogether. The launch of groundbreaking products like the iPhone, iPad, and Apple Watch has fueled its growth. But what’s driving its stock price now? Let’s find out in the next section.

Key Milestones in Apple’s Stock Journey

- 2007: Introduction of the iPhone

- 2010: Launch of the iPad

- 2020: Breakthrough in services revenue

Factors Influencing Apple Stock Price Prediction

Now that we’ve got the history out of the way, let’s focus on the factors that influence Apple stock price prediction. It’s not just about the company’s performance; external factors also play a significant role. From global economic conditions to technological advancements, there’s a lot to consider.

One of the biggest factors is Apple’s product lineup. With new releases and updates, the company keeps its investors on their toes. Additionally, the growing emphasis on services like Apple Music and iCloud storage is adding to its revenue streams. But that’s not all. Regulatory changes, geopolitical tensions, and even environmental concerns can impact its stock price.

Top Factors to Watch

- New product launches

- Expansion of services

- Global economic trends

Expert Predictions: Where Is Apple Stock Headed?

So, what do the experts say about Apple stock price prediction? Analysts are divided, but most agree that the stock has potential. Some predict a steady increase, while others caution against volatility. It’s like a game of chess—every move matters.

One thing is certain—Apple’s innovation and market dominance give it an edge. The company’s focus on sustainability and user experience is resonating with consumers. This could translate into higher stock prices in the long run. But remember, predictions are just that—predictions. They’re not guarantees.

Key Predictions by Analysts

- Potential increase in stock price by 10-15% in the next year

- Growth driven by new product launches

- Expansion into emerging markets

Data and Statistics: Crunching the Numbers

Let’s talk numbers. According to recent data, Apple’s revenue has been on an upward trend. In the last quarter alone, it reported a revenue of over $90 billion. That’s a lot of dough! But what does this mean for its stock price?

Analysts suggest that Apple’s strong financial performance is a good indicator of future growth. The company’s cash reserves and strategic investments are also contributing factors. But here’s the kicker—market sentiment can change in a heartbeat. That’s why it’s important to stay informed and adapt to changing conditions.

Important Statistics to Consider

- Revenue growth of 10% YoY

- Increased services revenue by 15%

- Strong demand for new products

Market Trends: What’s Shaping the Future

Market trends are like the weather—they can change unexpectedly. For Apple, staying ahead of the curve is crucial. The company is constantly innovating and adapting to meet consumer demands. From augmented reality to artificial intelligence, Apple is exploring new frontiers.

Another trend to watch is the shift towards sustainability. Apple has committed to becoming carbon neutral by 2030. This not only aligns with global environmental goals but also appeals to eco-conscious consumers. As more investors prioritize ESG (Environmental, Social, and Governance) factors, Apple’s commitment could boost its stock price.

Emerging Trends to Watch

- Expansion into augmented reality

- Growth in AI and machine learning

- Focus on sustainability

Investor Sentiment: What Do They Think?

Investor sentiment plays a big role in stock price prediction. Right now, the sentiment towards Apple is largely positive. Investors are bullish about its future prospects, especially with the upcoming product launches. But sentiment can be fickle, and it’s important to keep an eye on market conditions.

Surveys and polls indicate that most investors believe Apple’s stock will continue to rise. However, some are cautious about potential headwinds. It’s a balancing act—weighing optimism against realism. As an investor, it’s crucial to stay informed and make decisions based on facts, not emotions.

Key Insights from Investor Surveys

- 70% of investors expect stock price to rise

- 20% are cautious about market volatility

- 10% are considering selling their shares

Risks and Challenges: What Could Go Wrong?

Every investment comes with risks, and Apple is no exception. While the company has a strong track record, there are challenges it needs to overcome. From supply chain disruptions to regulatory hurdles, there’s a lot to consider.

Another challenge is maintaining its competitive edge. With new players entering the tech market, Apple needs to keep innovating to stay ahead. Additionally, geopolitical tensions could impact its operations in certain regions. It’s a complex landscape, and investors need to be aware of these risks.

Potential Risks to Watch

- Supply chain disruptions

- Regulatory challenges

- Intense competition

Final Thoughts: Making Informed Decisions

Alright, we’ve covered a lot of ground. From understanding FintechZoom to exploring Apple stock price prediction, we’ve delved into the key factors that influence its future. But here’s the bottom line—investing is a journey, not a destination.

Before you make any decisions, take the time to research and analyze. Use tools like FintechZoom to gain insights and stay informed. And most importantly, don’t let emotions cloud your judgment. Remember, the stock market is unpredictable, and the only constant is change.

So, what’s next? Share your thoughts in the comments below. Are you bullish on Apple stock? Or do you think there are better investment opportunities out there? Let’s keep the conversation going and help each other make smarter financial decisions.

Table of Contents

- Understanding FintechZoom: A Quick Overview

- Apple’s Stock Price: A Historical Perspective

- Factors Influencing Apple Stock Price Prediction

- Expert Predictions: Where Is Apple Stock Headed?

- Data and Statistics: Crunching the Numbers

- Market Trends: What’s Shaping the Future

- Investor Sentiment: What Do They Think?

- Risks and Challenges: What Could Go Wrong?

- Final Thoughts: Making Informed Decisions

Analyzing Live fintechzoom apple stock Performance in 2024 FintechZoom

Apple Stock FintechZoom Analysis with Insights

fintechzoom NIO Stock Analysis 2024 Key Drivers Behind Recent Price